Real estate can be a great investment, and many people don’t know they can also put the property into their IRAs.

However, they have to be careful: one small mistake and an IRA’s tax advantages disappear.

However, they have to be careful: one small mistake and an IRA’s tax advantages disappear.

So what are the rules to follow to have a qualified real estate purchase?

- You can’t mortgage the property.

- You can’t work on the property yourself — you’ve got to pay an independent party to do any repairs.

- You don’t get the tax breaks if the property operates at a loss. You can’t claim depreciation either.

- All costs associated with the property must be paid out of your IRA and all income deposited into the IRA. You can find yourself in a bind if there isn’t enough cash in the IRA to deal with a major property expense.

- You can’t receive any personal benefit from the property — you can’t live in it or use it in any way. It has to be strictly for investment purposes. So that vacation property you’re considering buying or a house to rent to your kids — not allowable.

More rules for real estate in IRAs

Any investment made by your IRA must be considered an arm’s-length transaction: You can’t use money in your IRA to buy or sell real estate to or from yourself or family members. You can’t receive any indirect benefit either — you can’t pay yourself or a family member to be the property manager.

For a traditional IRA, you must take required minimum distributions at 70 1/2 and that applies with real estate as well. It can be awfully hard to sell real estate off in portions, so then how do you cover the required distributions without cash? These are problems you need to solve before you start your retirement investing. However, you can roll over money from the sale of one property to the purchase of another without any tax consequences, inside the IRA.

Three more points to weigh when thinking about investing in real estate IRAs:

- Your IRA cannot purchase a property that you currently own. IRS regulations don’t allow transactions that are considered self-dealing. They don’t allow your self-directed IRA to buy property from or sell property to any disqualified person — including yourself.

- A real estate investment needs to be titled in the name of your IRA, not to you personally. All documents related to the investment must be titled correctly to avoid delays.

- Real estate in an IRA can be purchased without 100 percent funding from your IRA. You can use undivided interest and partnering with others.

For more, see my post, “Using a Self-Directed IRA to Buy Real Estate.”

We’ve got your back

There are a lot of working parts to keep in mind if you want to hold real estate in your IRA, and it might not be right for everyone. With Simon Filip, the Real Estate Tax Guy, on your side, you can focus on your real estate investments while he and his team take care of your accounting and taxes. Contact him at sfilip@krscpas.com or 201.655.7411 today.

The

The  A capital gain is a profit made when you as an individual or business sell a capital asset — investments or real estate, for instance — for a higher cost than its purchase price. A capital loss is incurred when there’s a decrease in the capital asset value compared with its purchase price. Almost everything you own and use for personal or investment purposes is a capital asset: a home, personal-use items like furnishings, and collectibles.

A capital gain is a profit made when you as an individual or business sell a capital asset — investments or real estate, for instance — for a higher cost than its purchase price. A capital loss is incurred when there’s a decrease in the capital asset value compared with its purchase price. Almost everything you own and use for personal or investment purposes is a capital asset: a home, personal-use items like furnishings, and collectibles. The IRS recently issued guidance on the 20% tax deduction for Qualified Business Income (QBI) and rental real estate activity. Here’s what you need to know:

The IRS recently issued guidance on the 20% tax deduction for Qualified Business Income (QBI) and rental real estate activity. Here’s what you need to know:  on payroll.

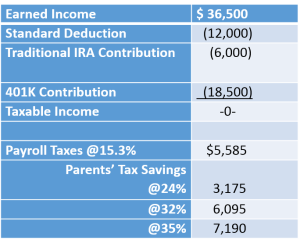

on payroll. If the entity is an LLC instead of an S-Corp, and your child is under 18, add back the payroll taxes of $5,585 to get your tax saving potential.

If the entity is an LLC instead of an S-Corp, and your child is under 18, add back the payroll taxes of $5,585 to get your tax saving potential. If you were married this past year, congratulations!

If you were married this past year, congratulations! The growing backlog of debt has proved too much for the agency, which continues to use four debt collection companies to round up outstanding payments from taxpayers who’ve been contacted numerous times and still haven’t coughed up any cash.

The growing backlog of debt has proved too much for the agency, which continues to use four debt collection companies to round up outstanding payments from taxpayers who’ve been contacted numerous times and still haven’t coughed up any cash. To start with, your deductions must exceed 7.5 percent of your adjusted gross income. And they have to fall into an IRS-approved category.

To start with, your deductions must exceed 7.5 percent of your adjusted gross income. And they have to fall into an IRS-approved category. With tax season right around the corner, it’s time to start thinking about closing your books out for the year and preparing all your tax documents.

With tax season right around the corner, it’s time to start thinking about closing your books out for the year and preparing all your tax documents. Even when you take the customer to court and you still don’t get your money, there’s a way to make lemonade from this lemon of a customer.

Even when you take the customer to court and you still don’t get your money, there’s a way to make lemonade from this lemon of a customer.