Form W-4 was revised after the 2017 Tax Reform Act. Here’s what you need to know to complete it accurately.

Form W-4 is completed by employees to advise their employers of the amount of federal income tax to withhold from their paycheck. Your employer will then remit the money withheld to the IRS along with your name and social security number. The tax withheld will be applied against your total income tax liability when you file your tax return in April.

In the past this has been a relatively simple and straightforward form to complete. However, the Form W-4 has been changed as a result of the passing of the TCJA back in late 2017.

Revised W-4 adds more detail

The major factor here is that the passing of the TCJA has gotten rid of all personal and dependent exemptions which affects the necessary and required amount of tax that needs to be withheld from your paycheck.

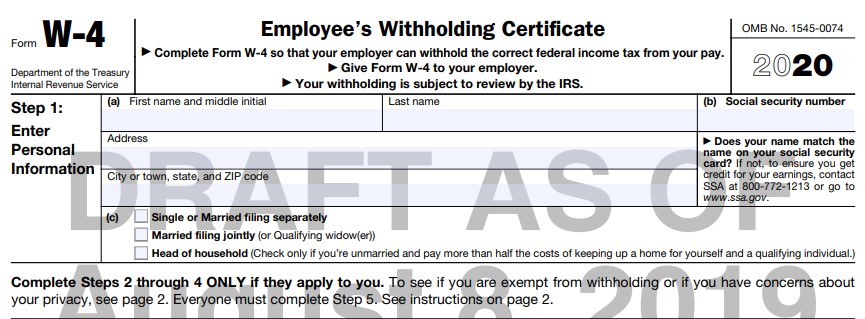

The revised Form W-4 issued by the IRS was intended to assist employees in making a more accurate determination of their income tax withholding needs based on the tax law changes. This new form is more detailed and includes various sections of specific withholding related information to help guide employees in accurately calculating the proper withholding amount.

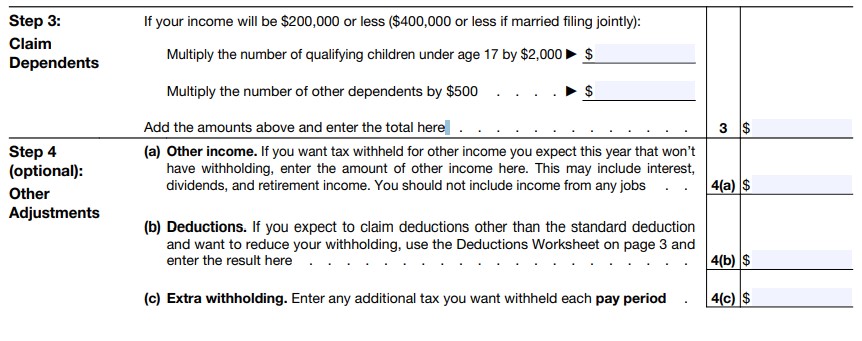

Page one of this form includes questions relating to the various sources of income you may have, dependents you can claim, and other income affecting adjustments. Step One involves providing general personal information as seen on the previous form. You will list your name, address, social security number, and filing status. The following steps two through four should only be completed if they apply to you.

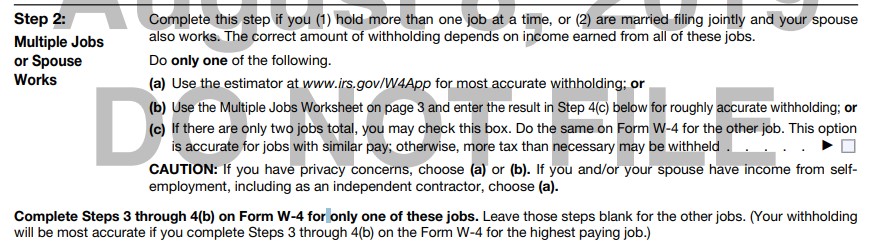

Step Two is for persons who work multiple jobs and have working spouses. There are three different methods to accurately calculate what the proper withholding should be based on your situation. You will need to calculate the correct amount of withholding based on the income earned from all jobs.

Step three accounts for certain tax credits associated with claiming dependents. Step four allows you to use your discretion to make any other adjustments to your withholding based on other income, deductions, and extra withholding that you may need to consider.

These form changes have been implemented as a response to the withholding issues that arose during the first year of the new tax law changes.

These form changes have been implemented as a response to the withholding issues that arose during the first year of the new tax law changes.

We’ve got your back

Tax season is getting underway. Are you ready? Trust KRS CPAs to help you with your tax strategy and preparation. Contact me at dpineda@krscpas.com or 201.655.7411 to learn more.

Sources:

https://www.cicplus.com/w-4-changes-for-2020/

https://www.irs.gov/pub/irs-dft/fw4–dft.pdf

https://www.staffone.com/resources/w-4-forms/

The TCJA modified the mortgage interest deduction for homeowners. Here’s what you need to know about the changes.

The TCJA modified the mortgage interest deduction for homeowners. Here’s what you need to know about the changes.

Before the

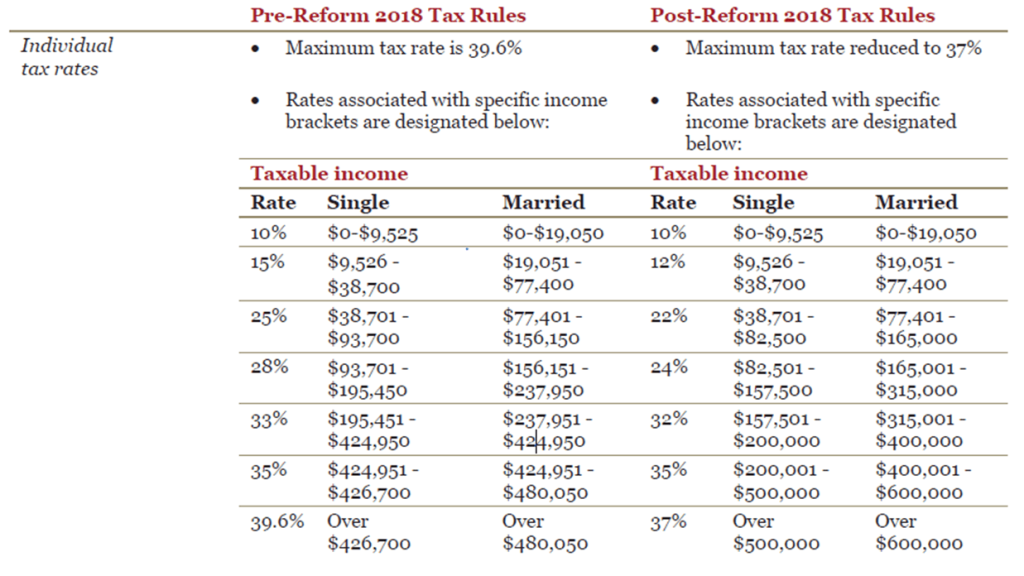

Before the  The new Tax Cuts and Jobs Act amends the Internal Revenue Code (IRC) to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. It is the most sweeping update to the U.S. tax code in more than 30 years, and from what we’re seeing, it impacts everyone’s tax situation a bit differently.

The new Tax Cuts and Jobs Act amends the Internal Revenue Code (IRC) to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. It is the most sweeping update to the U.S. tax code in more than 30 years, and from what we’re seeing, it impacts everyone’s tax situation a bit differently.