Updated IRS rules offer guidance for deductible expenses which may have been murky as a result of the Tax Cuts and Jobs Act

The rules being updated involve using optional standard mileage rates when figuring the deductible costs of operating an automobile for business, charitable, medical or moving expense purposes, among other issues.

The rules being updated involve using optional standard mileage rates when figuring the deductible costs of operating an automobile for business, charitable, medical or moving expense purposes, among other issues.

The full details are available in Revenue Procedure 2019-46 and Revenue Procedure 2019-48.

There are more succinct rules to substantiate the amount of an employee’s ordinary and necessary travel expenses reimbursed by an employer using the optional standard mileage rates. But know that you’re not required to use this method and that you may substantiate your actual allowable expenses, provided you maintain adequate records.

Miscellaneous itemized deductions clarified

The TCJA suspended the miscellaneous itemized deduction for most employees with unreimbursed business expenses, including the costs of operating an automobile for business purposes. However, self-employed individuals and certain employees, armed forces reservists, qualifying state or local government officials, educators, and performing artists may continue to deduct unreimbursed business expenses during the suspension.

The TCJA also suspended the deduction for moving expenses. However, this suspension doesn’t apply to a member of the armed forces on active duty who moves pursuant to a military order and incident to a permanent change of station.

Entertainment vs. food & beverage expenses

The IRS has also made it clear that the TCJA amended prior rules to disallow a deduction for expenses for entertainment, amusement or recreation paid for or incurred after Dec. 31, 2017. Otherwise allowable meal expenses remain deductible if the food and beverages are purchased separately from the entertainment, or if the cost of the food and beverages is stated separately from the cost of the entertainment.

More resources from KRS

KRSCPAS.com is accessible from your mobile device and is loaded with tax guides, blogs, and other resources to help you succeed. Check it out today!

| SHARE |

In a recent statement, the IRS noted that most taxpayers are issued refunds by the IRS in fewer than 21 days. If yours takes a bit longer, here are six things that may be affecting the timing of your refund:

In a recent statement, the IRS noted that most taxpayers are issued refunds by the IRS in fewer than 21 days. If yours takes a bit longer, here are six things that may be affecting the timing of your refund:

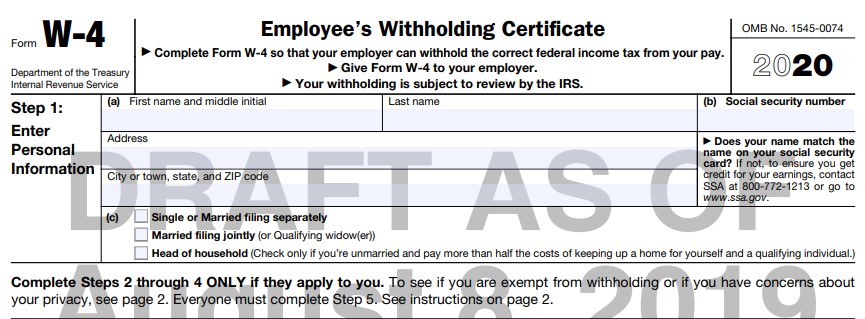

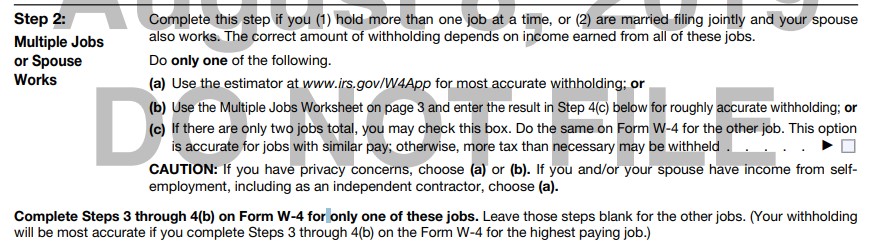

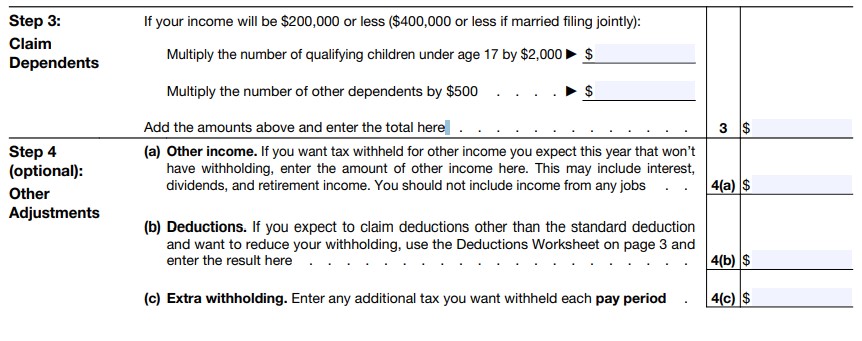

These form changes have been implemented as a response to the withholding issues that arose during the first year of the new tax law changes.

These form changes have been implemented as a response to the withholding issues that arose during the first year of the new tax law changes.

When should you revise your tax withholding?

When should you revise your tax withholding? Lots of business folks want to form an LLC because it can save you money on taxes, but there’s a caveat. The new tax law’s 20% deduction on qualified business income is subject to limitations that keep it from being just a giveaway for anyone who runs a business.

Lots of business folks want to form an LLC because it can save you money on taxes, but there’s a caveat. The new tax law’s 20% deduction on qualified business income is subject to limitations that keep it from being just a giveaway for anyone who runs a business.

We all live as if we have decades ahead of us, dealing with the present — we can’t know the future. And that’s why now is a great time to get a jump on estate planning.

We all live as if we have decades ahead of us, dealing with the present — we can’t know the future. And that’s why now is a great time to get a jump on estate planning. Save taxes with this smart estate planning strategy

Save taxes with this smart estate planning strategy Avoiding taxation should not be the only goal, or even the main goal, of your investment strategy.

Avoiding taxation should not be the only goal, or even the main goal, of your investment strategy.