With the 2018 filing season in full swing, the Internal Revenue Service offered taxpayers some basic tax and refund tips to clear up some common misbeliefs.

Myth 1: All Refunds Are Delayed

The IRS issues more than nine out of 10 refunds in less than 21 days. Eight in 10 taxpayers get their refunds faster by using e-file and direct deposit. It’s the safest, fastest way to receive a refund and is also easy to use.

While more than nine out of 10 federal tax refunds are issued in less than 21 days, some refunds may be delayed, but not all of them. By law, the IRS cannot issue refunds for tax returns claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) before mid-February. The IRS began processing tax returns on Jan. 29.

Other returns may require additional review for a variety of reasons and take longer. For example, the IRS, along with its partners in the state’s and the nation’s tax industry, continue to strengthen security reviews to help protect against identity theft and refund fraud.

Myth 2: Delayed Refunds, those Claiming EITC and/or ACTC, will be Delivered on Feb. 15

By law, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects the earliest EITC/ACTC related refunds to be available in taxpayer bank accounts or debit cards starting Feb. 27, 2018, if these taxpayers chose direct deposit and there are no other issues with their tax return. The IRS must hold the entire refund, not just the part related to these credits. See the Refund Timing for Earned Income Tax Credit and Additional Child Tax Credit Filers page and the Refunds FAQs page for more information.

Myth 3: Ordering a Tax Transcript a “Secret Way” to Get a Refund Date

Ordering a tax transcript will not help taxpayers find out when they will get their refund. The IRS notes that the information on a transcript does not necessarily reflect the amount or timing of a refund. While taxpayers can use a transcript to validate past income and tax filing status for mortgage, student and small business loan applications, they should use “Where’s My Refund?” to check the status of their refund.

Myth 4: Calling the IRS or a Tax Professional Will Provide a Better Refund Date

Many people mistakenly think that talking to the IRS or calling their tax professional is the best way to find out when they will get their refund. In reality, the best way to check the status of a refund is online through the “Where’s My Refund?” tool or via the IRS2Go mobile app. The IRS updates the status of refunds once a day, usually overnight, so checking more than once a day will not produce new information. “Where’s My Refund?” has the same information available as IRS telephone assistors so there is no need to call unless requested to do so by the refund tool.

Myth 5: The IRS will Call or Email Taxpayers about Their Refund

The IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. Recognize the telltale signs of a scam. See also: How to know it’s really the IRS calling or knocking on your door.

The IRS will NEVER:

- Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail a bill if taxes are owed.

- Threaten to immediately bring in local police or other law enforcement groups to have people arrested for not paying.

- Demand that taxes be paid without giving the taxpayer opportunity to question or appeal the amount owed.

- Ask for credit or debit card numbers over the phone.

For more information on tax scams see Tax Scams/Consumer Alerts. For more information on phishing scams see Suspicious e-Mails and Identity Theft.

We’ve Got Your Back

A trusted tax professional can provide helpful information and advice about the ever-changing tax code. Check out the New Tax Law Explained! For Individuals page and then contact managing partner Maria Rollins at mrollins@krscpas.com or 201.655.7411 for a complimentary initial consultation.

Tax Cuts and Jobs Act (“TCJA”)

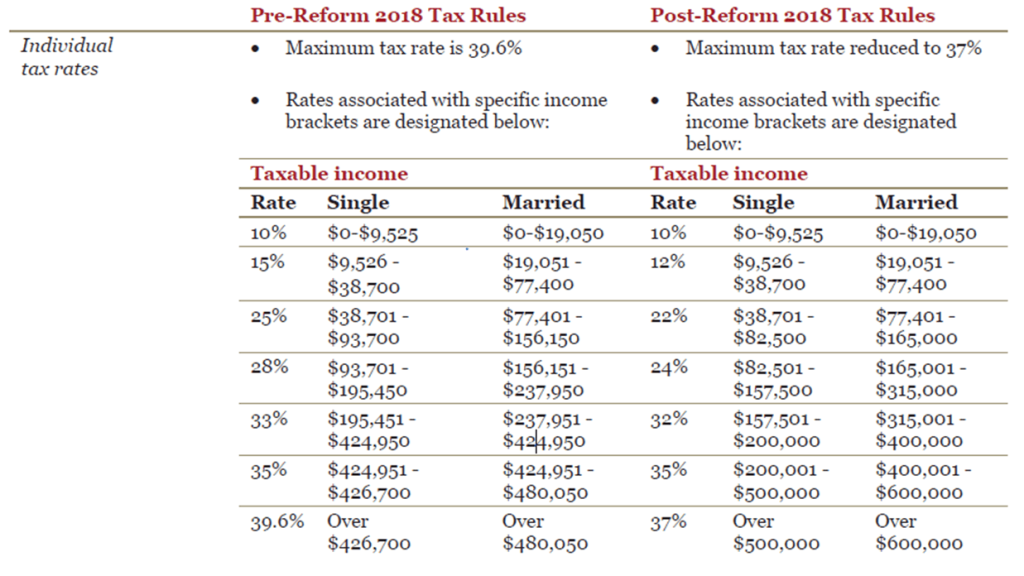

Tax Cuts and Jobs Act (“TCJA”) The new Tax Cuts and Jobs Act amends the Internal Revenue Code (IRC) to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. It is the most sweeping update to the U.S. tax code in more than 30 years, and from what we’re seeing, it impacts everyone’s tax situation a bit differently.

The new Tax Cuts and Jobs Act amends the Internal Revenue Code (IRC) to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. It is the most sweeping update to the U.S. tax code in more than 30 years, and from what we’re seeing, it impacts everyone’s tax situation a bit differently.

Specifically, a 1031 exchange allows a taxpayer to sell an investment property and reinvest in replacement property(ies) while deferring ordinary income, depreciation recapture and/or capital gains taxes. By deferring tax on the transaction, taxpayers will have more cash available for reinvestment.

Specifically, a 1031 exchange allows a taxpayer to sell an investment property and reinvest in replacement property(ies) while deferring ordinary income, depreciation recapture and/or capital gains taxes. By deferring tax on the transaction, taxpayers will have more cash available for reinvestment. For the purposes of this post, a foreigner is a corporation from outside the U.S. or an individual who is not a U.S. citizen or a resident. Generally, foreigners can use two types of legal entities in the US market to conduct business here: a limited liability company (LLC), or a C-corporation.

For the purposes of this post, a foreigner is a corporation from outside the U.S. or an individual who is not a U.S. citizen or a resident. Generally, foreigners can use two types of legal entities in the US market to conduct business here: a limited liability company (LLC), or a C-corporation. If your company uses independent contractors, you need to send them a 1099 form for their taxes.The IRS requires anyone providing a service who is not an employee and was paid $600 or more during the year, to be issued a 1099. There are exceptions for attorneys who have no dollar threshold, and payments to corporations, which are exempt from 1099 reporting.

If your company uses independent contractors, you need to send them a 1099 form for their taxes.The IRS requires anyone providing a service who is not an employee and was paid $600 or more during the year, to be issued a 1099. There are exceptions for attorneys who have no dollar threshold, and payments to corporations, which are exempt from 1099 reporting.

President Trump has proposed a detailed tax plan that will revise and update both the individual and corporate tax codes.

President Trump has proposed a detailed tax plan that will revise and update both the individual and corporate tax codes.