In determining gain or loss on sale of a partnership interest, taxpayers are often surprised to find they have a taxable gain.

For income tax purposes gain or loss is the difference between the amount realized and adjusted basis of the partnership interest in the hands of the partner.

Amount Realized

The amount the partner will realize will include any cash and the fair market value of any property received. Further, if the partnership has liabilities, the amount realized will include the partner’s share of the partnership liabilities. If the partner remains liable for the debt, the amount realized will not include the partner’s share of the liability.

Examples of Amount Realized:

Example 1 – Sale of Partnership interest with no debt:

Amy is a member in ABC, LLC which has no outstanding liabilities. Amy sells her entire interest to Dave for $30,000 of cash and property that has a fair market value of $70,000. Amy’s amount realized is $100,000.

Example 2 – Sale of partnership interest with partnership debt:

Amy is a member of ABC, LLC and has a $23,000 basis in her interest. Amy’s membership interest is 1/3 of the LLC. When Amy sells her 1/3 interest for $100,000 the partnership has a liability of $9,000. Amy’s amount realized would be $103,000 ($100,000 + ($9,000 x 1/3).

Gain Realized

Generally, a partner selling his partnership interest recognizes capital gain or loss on the sale. The amount of the gain or loss recognized is the difference between the amount realized and the partner’s adjusted tax basis in his partnership interest.

Example 1 (from above)- Sale of Partnership interest with no debt:

Assume Amy’s basis was $40,000. Amy would realize a gain of $60,000 ($100,000 – $40,000).

Example 2 (from above) – Sale of partnership interest with partnership debt:

Amy’s basis was $23,000. Amy would realize a gain of $80,000 ($103,000 realized less $23,000 basis).

Character of Gain

Partnership taxation establishes the general rule that gain on sale a partnership interest receives favorable capital gain treatment. However, gains attributable to so-called “hot assets,” which include inventory, depreciation recapture, and accounts receivable of a cash basis partnership are taxed at less favorable ordinary income rates.

To the extent that a sale is attributable to the selling partner’s share of the hot assets, the resulting gain or loss is taxed at ordinary income rates. When real estate is sold to the extent the gain on sale is attributable to depreciation deductions, the resulting gain is treated as unrecaptured IRC §1250 section gain. §1250 gain is taxed at a flat 25% rate.

Like-Kind Exchange

It is important to note that in IRC §1031 (like-kind exchange), non-recognition treatment does not apply to exchanges of partnership interests.

We’ve Got Your Back

If you’re selling your partnership interest, we can help you plan the sale so that you pay no more tax than necessary. Contact Simon Filip, the Real Estate Tax Guy, at sfilip@krscpas.com or 201.655.7411 today.

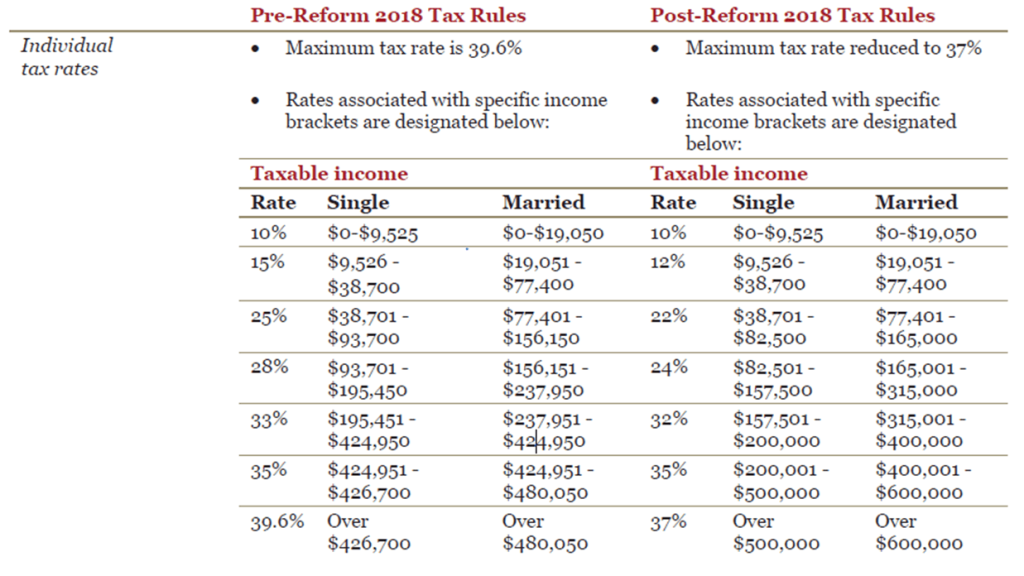

The new Tax Cuts and Jobs Act amends the Internal Revenue Code (IRC) to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. It is the most sweeping update to the U.S. tax code in more than 30 years, and from what we’re seeing, it impacts everyone’s tax situation a bit differently.

The new Tax Cuts and Jobs Act amends the Internal Revenue Code (IRC) to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. It is the most sweeping update to the U.S. tax code in more than 30 years, and from what we’re seeing, it impacts everyone’s tax situation a bit differently.

Specifically, a 1031 exchange allows a taxpayer to sell an investment property and reinvest in replacement property(ies) while deferring ordinary income, depreciation recapture and/or capital gains taxes. By deferring tax on the transaction, taxpayers will have more cash available for reinvestment.

Specifically, a 1031 exchange allows a taxpayer to sell an investment property and reinvest in replacement property(ies) while deferring ordinary income, depreciation recapture and/or capital gains taxes. By deferring tax on the transaction, taxpayers will have more cash available for reinvestment. Recently, I had a taxpayer call me regarding the sale of a rental property. The taxpayer sold the property for approximately $500,000 and there was approximately $100,000 of tax basis remaining after depreciation. The combined federal and state tax exposure was almost $100,000.

Recently, I had a taxpayer call me regarding the sale of a rental property. The taxpayer sold the property for approximately $500,000 and there was approximately $100,000 of tax basis remaining after depreciation. The combined federal and state tax exposure was almost $100,000.