Does your business qualify as a pass-through for tax purposes?

If you’re an entrepreneur and you’ve heard other business owners talking about the qualified business income deduction (also called Section 199A), you’re probably asking yourself, “Should I incorporate to help save on taxes?” and “What entity should I select?”

Lots of business folks want to form an LLC because it can save you money on taxes, but there’s a caveat. The new tax law’s 20% deduction on qualified business income is subject to limitations that keep it from being just a giveaway for anyone who runs a business.

Lots of business folks want to form an LLC because it can save you money on taxes, but there’s a caveat. The new tax law’s 20% deduction on qualified business income is subject to limitations that keep it from being just a giveaway for anyone who runs a business.

To qualify for the full deduction, your taxable income must be below $157,500, or $315,000 if you’re married and you and your spouse file jointly. If your income is below the threshold, you may take the deduction no matter what business you’re in. But if your income is higher, there are limits on who can take the break.

Some fine print about qualified businesses

- What exactly is a qualified business? The IRS notes this break is for sole proprietorships, partnerships, S corporations, and some trusts and estates. C corporations are specifically excluded.

- There are special rules and limits for “specified service trades or businesses.” The IRS defines these as businesses such as health, law, accounting, among others, “where the principal asset is the reputation or skill of one or more of its employees or owners.”

- The deduction doesn’t lower your adjusted gross income, and you don’t have to itemize on your taxes to take it.

- If you qualify, the 20% break will apply to the lesser of your qualified business income or your taxable income minus capital gains.

- There’s a wage and capital limitation: it is the greater of 50% of W-2 wages or 25% of W-2 wages plus 2.5% of unadjusted basis of all qualified property. There is a 20% deduction of REIT dividends and distributions from publicly traded partnerships.

- In counting qualified business income, the deductible part of self-employment tax, self-employed health insurance, and deductions for contributions to qualified retirement plans like SEPs, SIMPLEs and qualified plan deductions are included.

- You have to decide how you should set up your business. As noted above, multiple entities are eligible for the pass-through treatment, but there are other implications you need to consider, such as how Social Security taxes will be paid.

- Finally, don’t assume that the creation of a pass-through entity automatically creates a windfall. You’ll want to weigh how much you’ll save on taxes versus how much you’ll pay to set up an eligible entity.

How can you optimize the deduction?

Here are a few ways:

- Consider operating as a PTP, or publicly traded partnership, which is not subject to the W-2 wage limit or the qualified property cap.

- Consider multiplying the $157,500 per person threshold by gifting business ownership interest to children or non-grantor trusts.

- For partners, consider switching from guaranteed payments, which don’t qualify, to preferred returns, which do.

This is just an introduction to a complex topic. Also, new guidance from the IRS may change some of the details, which means many provisions are not etched in stone. For example, the IRS issued in late September Revenue Procedure 2019-38, which offers a safe harbor allowing certain interests in rental real estate, including interests in mixed-use property, to be treated as a trade or business for purposes of the QBI deduction, under Section 199A.

KRS has your back on understanding pass-through entities

Be sure to get professional advice to make sure you’re making the right decisions about your pass-through entity. KRS CPAs offers unbiased financial and tax guidance to help you with this complicated subject. Contact us today for a complimentary initial consultation.

KRSCPAS.com is accessible from your mobile device and is loaded with tax guides, blogs, and other resources to help you succeed. Check it out today!

Does your home office qualify for a tax deduction?

Does your home office qualify for a tax deduction? The

The  A capital gain is a profit made when you as an individual or business sell a capital asset — investments or real estate, for instance — for a higher cost than its purchase price. A capital loss is incurred when there’s a decrease in the capital asset value compared with its purchase price. Almost everything you own and use for personal or investment purposes is a capital asset: a home, personal-use items like furnishings, and collectibles.

A capital gain is a profit made when you as an individual or business sell a capital asset — investments or real estate, for instance — for a higher cost than its purchase price. A capital loss is incurred when there’s a decrease in the capital asset value compared with its purchase price. Almost everything you own and use for personal or investment purposes is a capital asset: a home, personal-use items like furnishings, and collectibles. Your business represents a big part of your wealth. Here’s why you need to protect it with a succession plan.

Your business represents a big part of your wealth. Here’s why you need to protect it with a succession plan. You will want to prepare your financial statements in accordance with an accounting framework that’s appropriate for your business. Most of the time, you’ll opt for a CPA to produce your financial statements. Getting an accountant’s blessing is especially useful when you are applying for more credit from a bank.

You will want to prepare your financial statements in accordance with an accounting framework that’s appropriate for your business. Most of the time, you’ll opt for a CPA to produce your financial statements. Getting an accountant’s blessing is especially useful when you are applying for more credit from a bank. on payroll.

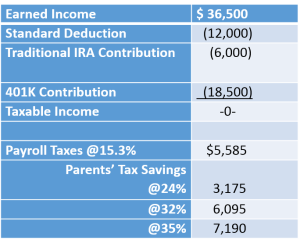

on payroll. If the entity is an LLC instead of an S-Corp, and your child is under 18, add back the payroll taxes of $5,585 to get your tax saving potential.

If the entity is an LLC instead of an S-Corp, and your child is under 18, add back the payroll taxes of $5,585 to get your tax saving potential.

With tax season right around the corner, it’s time to start thinking about closing your books out for the year and preparing all your tax documents.

With tax season right around the corner, it’s time to start thinking about closing your books out for the year and preparing all your tax documents.