How do you begin your search for a business loan?

Many banks and alternative lenders are out there vying for your attention. Once you decide on a lender, what’s next?

Here are the steps to obtaining your business loan:

Step 1. Determine why you need the money.

This will drive your choice of lender and loan type. Different kinds of loans can be used to:

- Cover the costs of launching a business.

- Help you buy an existing business.

- Purchase specialized equipment.

- Provide working capital for payroll, marketing and hiring.

- Resolve cash-flow problems — often needed for a seasonal business.

- Help you expand your business.

- Refinance an existing loan at more favorable terms.

Step 2. Calculate how much financing you can afford.

Determine your debt service coverage ratio by looking into your finances. Take the following steps:

- Use a business loan calculator to find the monthly payment on your loan before you commit.

- Check out your company’s profit and loss statement. Will incoming revenue be enough to cover the monthly payment?

- Determine your debt service coverage ratio or DSCR. Take your average monthly net income and divide it by your monthly loan payment. It should be above one. If it’s below, maybe a smaller loan with a better interest rate will work.

Step 3. Consider different loan products.

Consider the following options:

- Bank loans — The cheapest financing option. Interest rates can be as low as 5%. There are some hurdles: You’ll need a great personal credit score, your business should be profitable and you’ll need personal or business assets to use as collateral.

- SBA loans — Slightly more expensive than bank loans and easier to qualify for. Rates range from 5% to 10%.

- Medium-term alternative loans — A faster online counterpart to SBA loans or bank loans. Interest rates may be as high as 20%, but you can get approval in less than two weeks.

- Short-term alternative loans — Just three to 18 months to be repaid with daily or weekly repayments. Interest rates can be very high, but you’re paying for convenience and quick approval. These may be the best (or only) alternative you have if you’ve been in business for less than a year or you have a weak credit score.

Step 4. Get your loan documents in order.

This includes all your financial statements and tax documents. (Depending on your situation, you may need an audit, review or compilation.) No matter which options you choose, you’ll need paperwork to move forward.

- Be aware the more difficult it is to qualify for the loan, the more paperwork is required.

- Expect to be asked for your credit score, your average bank balance, how long you’ve been in business, your annual revenue, a profit and loss statement and a balance sheet, as well as personal and business tax returns.

- Take into account costs, which may include application fees, origination fees, guarantee fees for SBA loans, credit check fees, prepayment fees for paying back the loan early, and late payment fees.

A final tip

This is just an introduction to a complex process. Getting a business loan is a big step, so whatever you do, be sure to get the advice of a financial professional before moving forward.

KRSCPAS.com is accessible from your mobile device and is loaded with tax guides, blogs, and other resources to help you succeed. Check it out today!

The

The  A capital gain is a profit made when you as an individual or business sell a capital asset — investments or real estate, for instance — for a higher cost than its purchase price. A capital loss is incurred when there’s a decrease in the capital asset value compared with its purchase price. Almost everything you own and use for personal or investment purposes is a capital asset: a home, personal-use items like furnishings, and collectibles.

A capital gain is a profit made when you as an individual or business sell a capital asset — investments or real estate, for instance — for a higher cost than its purchase price. A capital loss is incurred when there’s a decrease in the capital asset value compared with its purchase price. Almost everything you own and use for personal or investment purposes is a capital asset: a home, personal-use items like furnishings, and collectibles. Your business represents a big part of your wealth. Here’s why you need to protect it with a succession plan.

Your business represents a big part of your wealth. Here’s why you need to protect it with a succession plan. You will want to prepare your financial statements in accordance with an accounting framework that’s appropriate for your business. Most of the time, you’ll opt for a CPA to produce your financial statements. Getting an accountant’s blessing is especially useful when you are applying for more credit from a bank.

You will want to prepare your financial statements in accordance with an accounting framework that’s appropriate for your business. Most of the time, you’ll opt for a CPA to produce your financial statements. Getting an accountant’s blessing is especially useful when you are applying for more credit from a bank. on payroll.

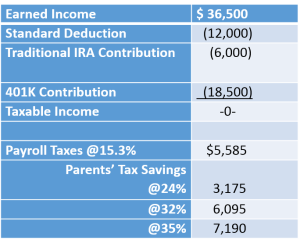

on payroll. If the entity is an LLC instead of an S-Corp, and your child is under 18, add back the payroll taxes of $5,585 to get your tax saving potential.

If the entity is an LLC instead of an S-Corp, and your child is under 18, add back the payroll taxes of $5,585 to get your tax saving potential. I frequently receive requests to quickly value a business by applying a “rule of thumb”, that is, application of a simple formula to the gross or net income of a business to determine its value. The value of a business is based on two factors: cash flow and risk. Using a rule of thumb to value a business considers neither.

I frequently receive requests to quickly value a business by applying a “rule of thumb”, that is, application of a simple formula to the gross or net income of a business to determine its value. The value of a business is based on two factors: cash flow and risk. Using a rule of thumb to value a business considers neither.

With tax season right around the corner, it’s time to start thinking about closing your books out for the year and preparing all your tax documents.

With tax season right around the corner, it’s time to start thinking about closing your books out for the year and preparing all your tax documents.