Be Aware of New W-2 and 1099 Filing Deadlines

In an effort to combat fraud, the Protecting Americans from Tax Hikes (PATH) Act of 2015 was enacted. It revises the filing deadline for Form W-2 and certain types of Form 1099.

Without proper planning, these revisions can cause some real stress for small businesses.

In the past, there were always two dates to consider when filing your employer tax forms. Forms were due to recipients on January 31st and forms were due to the government agencies (IRS and Social Security Administration) on February 28th.

Effective with 2016 tax forms, W-2’s and 1099’s with Box 7 entries are now due by January 31st for both recipient and government agency filings. Form 1099 box 7 reports non-employee compensation.

In practice, we have found that many businesses do not have correct recipient information for employees and independent contractors, and unfortunately do not realize this until it is time to prepare the recipient copies of the forms. In the past, the issuer had until February 28th to track down or correct any incomplete recipient information.

If you fail to file a correct W-2 or 1099 information return by the due date, and you cannot show reasonable cause, you may be subject to a penalty. There are also penalties if you report an incorrect TIN (taxpayer identification number) or fail to report a TIN. Accordingly, collecting correct information timely is very important.

Complying with PATH

Our recommendations to businesses to assure compliance with the new due dates are as follows:

- Verify the accuracy of all employee information NOW

- Review all vendor files NOW and confirm that all applicable files include the vendor’s name, address and TIN

- Obtain Form W-9, “Request for Taxpayer Identification Number and Certification”, for each new vendor PRIOR to issuing any payment to the vendor

- Contact all vendors with missing information NOW to allow sufficient time to receive the correct information (it may be difficult to secure the correct information if you no longer do business with the vendor)

Due to the shortened filing deadline between the end of the year and the filing due date, it is essential that you have all the complete and accurate filing information by early January.

There are many ways to obtain payment processors. For example, they can be found through banks, online providers and companies such as PayPal. They all have different rates. Some may require contracts or mandatory leasing of their equipment (credit card machine), so it is very important that you choose one that will work best for your company’s needs.

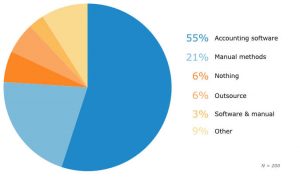

There are many ways to obtain payment processors. For example, they can be found through banks, online providers and companies such as PayPal. They all have different rates. Some may require contracts or mandatory leasing of their equipment (credit card machine), so it is very important that you choose one that will work best for your company’s needs. Depending upon the version purchased, these packages will offer the user the ability to perform basic bookkeeping functions such as

Depending upon the version purchased, these packages will offer the user the ability to perform basic bookkeeping functions such as It is unlikely that any single action will result in a significant increase in cash flow, but the here are some areas where improvement may be achieved:

It is unlikely that any single action will result in a significant increase in cash flow, but the here are some areas where improvement may be achieved:

Reconciling your company bank statements does not have to be an onerous chore. Of course, it’s much easier to track customer payments by credit card or check. But what about reconciling your bank statements when it comes to cash receipts?

Reconciling your company bank statements does not have to be an onerous chore. Of course, it’s much easier to track customer payments by credit card or check. But what about reconciling your bank statements when it comes to cash receipts?