Employee benefit plans are impacted by the CARES Act. Here’s what you need to know about coronavirus-related plan distributions and which of your employees may qualify for them

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed by Congress. The CARES Act provides immediate and temporary relief for retirement plan sponsors and their participants with respect to employer contributions, participant distributions and participant loans.

The provisions of the CARES Act may be effective and operationalized immediately, prior to amending the plan document. Plan amendments are not required until December 31, 2022.

Plan amendments for for coronavirus-related distributions

The Act provides that qualified defined contribution plans may be amended to allow participants to take up to $100,000 “coronavirus-related distributions” prior to the end of 2020. The distributions are exempt from the 10% early withdrawal penalty and taxable over three years. Participants can take up to three years to repay all or any part of those distributions. The repayment would be treated as a tax-free rollover when repaid to the plan.

Coronavirus-related distributions from defined benefit plans would not be permitted because of the in-service distribution restrictions generally applicable to such plans.

Repayments delayed

The Act increases the maximum permissible plan loan amount to $100,000 or 100% of a participant’s vested account balance (whichever is less) for individuals who qualify for a coronavirus-related distribution. The Act delays for one year repayments for currently outstanding plan loans that are due during the remainder of 2020 for those individuals who qualify for a coronavirus-related distribution.

A “coronavirus-related distribution” is a distribution made in 2020 to an individual who is diagnosed with COVID-19, has a spouse or dependent diagnosed with COVID-19, or experiences adverse financial consequences as a result of being quarantined, furloughed or laid off or having work hours reduced due to COVID-19, being unable to work due to lack of childcare due to COVID-19, or the closing or reducing hours of a business owned or operated by the individual due to COVID-19.

The Act also extends the due date to January 1, 2021 for all 2020 minimum required employer contributions for single-employer defined benefit plans.

Concerned about your employee benefit plan?

If you have further questions or concerns about employee benefit plans, contact Qiming Liu at qliu@krscpas.com or 201-655-7411. You can also check our Coronavirus Resources Page for more updates.

Document review: Are the papers in place?

Document review: Are the papers in place? Key steps to take before pursuing bankruptcy include:

Key steps to take before pursuing bankruptcy include: The rules being updated involve using optional standard mileage rates when figuring the deductible costs of operating an automobile for business, charitable, medical or moving expense purposes, among other issues.

The rules being updated involve using optional standard mileage rates when figuring the deductible costs of operating an automobile for business, charitable, medical or moving expense purposes, among other issues. In a recent statement, the IRS noted that most taxpayers are issued refunds by the IRS in fewer than 21 days. If yours takes a bit longer, here are six things that may be affecting the timing of your refund:

In a recent statement, the IRS noted that most taxpayers are issued refunds by the IRS in fewer than 21 days. If yours takes a bit longer, here are six things that may be affecting the timing of your refund:

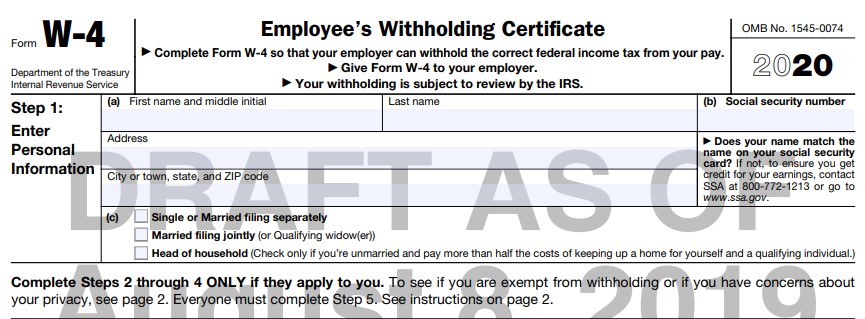

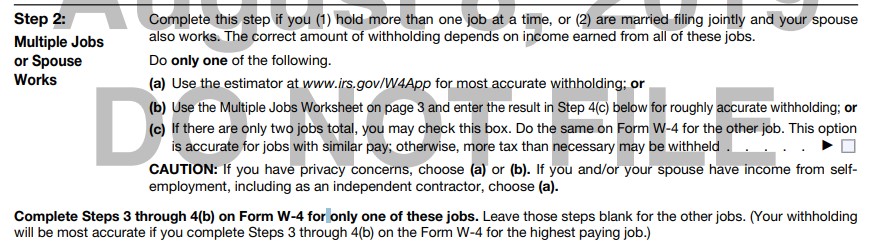

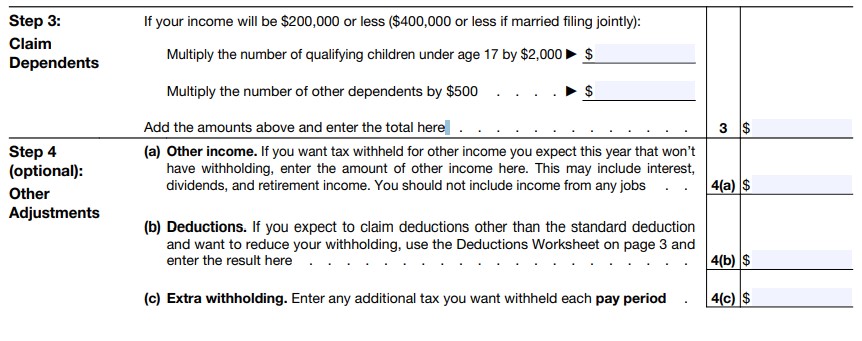

These form changes have been implemented as a response to the withholding issues that arose during the first year of the new tax law changes.

These form changes have been implemented as a response to the withholding issues that arose during the first year of the new tax law changes.

When should you revise your tax withholding?

When should you revise your tax withholding? Lots of business folks want to form an LLC because it can save you money on taxes, but there’s a caveat. The new tax law’s 20% deduction on qualified business income is subject to limitations that keep it from being just a giveaway for anyone who runs a business.

Lots of business folks want to form an LLC because it can save you money on taxes, but there’s a caveat. The new tax law’s 20% deduction on qualified business income is subject to limitations that keep it from being just a giveaway for anyone who runs a business.